A Ponzi scheme survives so long as new buyers enter the scheme to support the skim the operator is taking and the payments to the people at the top of the pyramid. Once new entrants cease, the scheme collapses and a chase scene ensues.

Government debts require servicing, and servicing those debts with increasing government payout demands for other programs depends upon a growing economy. Economic growth depends upon two factors: productivity increases and population growth. In Europe and Japan, populations are on a reverse course overall. Birth ratios in those regions are lower than what is required to maintain a steady population. That means, as the populations decline there, their government spending programs will be unsustainable without unprecedented levels of productivity increases.

The USA has a similar situation, but immigration flows help to sustain the growth in the US population. Immigration flows bring in other issues, and the current mood among many Americans is to implement tighter restrictions on illegal immigration. Legally, that makes sense. After all, illegal immigration is illegal. Cutting it off will have economic consequences in reducing the growth of the US population and thereby reducing its overall capacity to grow.

I’m not advocating opening the borders and letting everyone just show up in the States, looking for a job. I’m just pointing out that there is a cost for everything. Restricting immigration can lead to a decline in growth, which can be a contributing factor to increased unsustainability of government programs. Cutting those programs themselves will also depress overall demand, putting a state in deeper economic woes.

Something to think about.

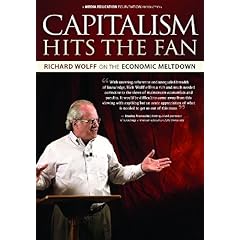

Marxist economists haven’t died and become part of the fossil record. They’ve adapted and continue to raise critical questions of both Keynesian and Classical economic viewpoints. I recently saw one such viewpoint on LinkTV and felt moved to comment on it.

Marxist economists haven’t died and become part of the fossil record. They’ve adapted and continue to raise critical questions of both Keynesian and Classical economic viewpoints. I recently saw one such viewpoint on LinkTV and felt moved to comment on it.