OK, all my students: quit gravedigging old threads and read this one, mmmkay?

Debt and Deficit

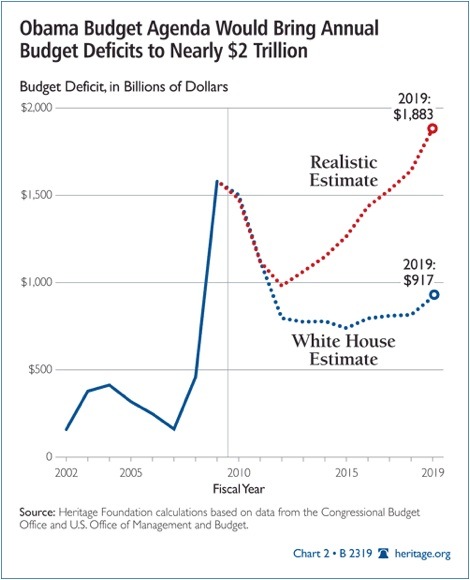

I saw a version of that chart in this article by John Mauldin. I strongly recommend you read it. He takes Macroeconomics 101 and uses it to examine our current situation. His conclusion: even the Obama projections of future deficits are not a good thing.

There are some areas where he has to take Macro 101 to task: we have to teach that there is a GDP Multiplier equal to 1/(1-MPC), where MPC is the Marginal Propensity to Consume. It’s a fancy little equation, but essentially worthless in the long run. In the long run, you see, the GDP Multiplier is zero.

“This means there is no long term income benefit from stimulus programs. According to the latest academic research, the most recent $800 billion stimulus plan will boost economic activity in the short run, but will surely depress economic activity over time. The government problem is complicated by the fact that the tax multiplier is 3, meaning that a 1% change in taxes will change GDP by about 3% over time.” – Robert Barro

Taxes have to go up in order to meet federal spending obligations, which include making interest payments on the debt. Those tax increases are going to drag the economy downward, and that’s just one influence, at the end a lot of people will need extra help from companies like the CreditAssociates. There really isn’t any argument on the GDP Multiplier being 0 in the long run – both the President’s Council of Economic Advisors and many other economists agree on that fact. It’s a short-term goose to the economy that will flatten out over time. Japan’s 20 years of huge deficits and flat growth are testament to that.

Now, in order for the government to borrow this huge amount of money to make GDP look nice in the short run, it has to find lenders. When it attracts lenders, it is pulling them away from offering loanable funds to firms that are looking to make capital investments. That’s the AP Economics phrase. The shorter version is that the government is “crowding out” investment, which keeps it from going to businesses that are looking to grow themselves. That means we’ll have a reduction in total growth.

If you look at the deficit this year, $400 billion of its funding came from foreign lenders. The rest came from domestic banks that are too scared to lend to any entity other than the USG. Small and medium businesses are unable to borrow money to keep things going, and are having to shut their doors.

Commercial property values continue to decline, so banks are going to be getting out of that market, with harsh results for businesses, as banks underwrite 45% of all commercial property loans. As they leave that market, those small and medium businesses are going to have to keep using the garage – or go back to it – and their hoped-for jobs will not come into existence.

So we’re already looking at a lack of stimulus to demand. In Macro 101 terms, that means the aggregate demand curve stays where it is or drifts further to the left, deeper into recession territory. Another Macro 101 concept is that raising taxes will reduce demand. Because most states have to balance their budgets, they’ve already been raising taxes. That’s one drag on the economy. Congress is going to raise taxes in 2011 by letting the Bush-era tax cuts expire. That’s going to be another big drag on the economy. (For the older folks, I’m not referring to Don Rickles in “Bikini Beach.”)

The hard truth is that we’re looking at some long-run changes in the economy. Here it is in Macro 101 terms: The Long Run Phillips Curve is shifting to the right – that means a higher natural rate of unemployment. What we think of as recessionary now will look passably good in a few years. The LRPC’s short-run cousin may also shift to the right as we become used to more and more government printing of money. The Aggregate Supply curve will not be growing as much as it did in the past. That’s going to mean less increase in the LRAS and the Production-Possibility Frontier. If more businesses close their doors and more banks fail, we may see actual shrinkage in those areas if productive capacity does not at least replace depreciating capital. The government is trying to boost AD to get things rolling again, but increases in taxes are canceling out a big chunk of that boost. Moreover, the fact that the government has to borrow so much money is leaving hardly anything for firms to borrow, which limits their ability to boost demand with more investment spending.

That’s just with what we have on the table right now. If we were to see shocks in commodity prices – particularly petroleum – we’d watch as prices went up along with unemployment as AS shifts leftward towards stagflation. Then again, we could also have a deflationary bank collapse hit at the same time so that prices stay normal, but we have even more job losses – hardly a reason to celebrate.

What gets me the most is that I can teach this to my Economics students RIGHT NOW and they can get the big picture. There are people with advanced degrees in Economics that think they can somehow calculate their way around reality that are trying to say we’re in a recovery and on our way to happy days again. Folks, when something is too good to be true, it is. The key lesson in Macro 101 is that everything has its cost and there ain’t no such thing as a free lunch.

Get ready for the bill, kiddos. Get ready for the bill.

Is the amount on the graph each year the amount of money that is added to our debt?

Also, when it was mentioned today in class that 20% of the budget goes to paying the interest off of our debts, why do we pay that off at all? I remember you told us that we never pay the debt off so why not let the interest accumulate as well?

If we let the interest accumulate, then no one will lend us money, because we won’t be paying them.

Both of you are a bit off… when one takes on debt, one MUST make the interest payments or be considered to be in default. The USG, therefore, must now spend 20% of its budget on paying off interest on the debt. That doesn’t do a thing for the principal.

I find it funny that the entire country is freaking out about this the budget deficit being this high. Don’t get me wrong, it’s a bad thing! But it’s about to get a lot worse… As Troyka says, ‘tough widgies’

http://news.bbc.co.uk/2/hi/business/8221207.stm

I also found this link…

So if the debt has gone up so much just in the past few months, how accurate is this graph?

… and it tough wudgies.

Wouldn’t, in time, the interest increase as we borrow more and more money and then, eventually, the USG wouldn’t make enough to pay the interest?

Also, if we know that other counties want us to accumulate the debt by borrowing more because they want more money from interest, wouldn’t it be a wiser thing for the USG to gain a budget surplus and start paying off that principal amount so that we don’t have to keep losing money to interest (I was always taught that letting interest accumulate at all was bad)?

Yes, interest can get to where we can’t pay it no more. That will be very bad, because it’ll lead to austerity measures, which are exactly what David’s second post describe.

Think about it: what would it take to get the budget to where we’re not borrowing any more money and are paying off the debt. How much would GDP decrease if we did that?

So if we can’t come up with a way to get the budget straight and pay off the debt little by little, we will essentially become bankrupt?

Yes. If we borrow too much, we will go bankrupt. That’s pretty much an iron law of finance.

Why don’t we just sacrifice the GDP for one year and use the 14 trillion to completely pay off the debt? That way, the 20% that goes to interest the following year will instead money that the government can use for better causes. Then, since our plate is clean, we could just never borrow again and spend within our limits. It might be harmful to the people but we could have survival of the fittest for one year and then a little afterward, which might seem bad but it is better then complete doom in the future for all of America.

On another note, the US gives a lot of foreign aid (I have a news article showing where some of it goes). If we have so much debt, why are we giving money away when we need it and could use it so that we wouldn’t have to borrow as much?

I still don’t get what the point of borrowing money and not paying the principal is. I know the benefit is that a nation has money on hand to use however it wants but the end cost of paying more than was used doesn’t seem to be worth it.

I understand that when the US was in its early years of existence the point of having a relatively large debt(which the colonists owned) was to make sure the citizens did everything possible to make sure the country they invested in succeeding; it was a safeguard against the collapse of the nation. Now it’s the opposite, the debt is threatening the collapse of the nation. Mr. Webb, why do you think nothing is being done to stop the debt from accumulating?

@David: Then we starve. Not an option.

@Hugo: It’s called being irresponsible when people do it, high finance when the government does it.

Why can’t we spend government money more efficiently? So that less money will stimulate the economy by increasing consumption and investment. If we do so we will be able to cut the deficit and eventually start paying off the debt.

This is a link I found that details ways that the government wastes revenue: http://www.billshrink.com/blog/government-wastes/

Also, if we limit imports can’t we cut the trade deficit. As we rely increasingly on imports from foreign countries manufacturing centers are closing down and gross investment is decreasing. So if there was still enough investment, cutting government spending will have less of an effect on the GDP.

This is a link I found about the increasing dependence on imports:

http://www.americaneconomicalert.org/view_art.asp?Prod_ID=2638

http://www.ecb.int/press/key/date/2006/html/sp060427_appendix.en.pdf

I saw a graph like this in the TIME magazine i get. It was talking about how Obama’s budget deficit will actually make our budget issue increase due to the lack of it actually happening.

What are ways the government can spend more efficiently, David? I think it is easier said than done.

As for importing less, that would be a dumb decision on the private firms part wouldnt’t it? I mean, the labor there is cheaper so the firms have less expenditures and more revenue. From there, we hope the money comes back to us. If you decrease imports and decrease revenue because of the higher costs of labor and probably material too, then GDP would likely decrease (I think).

So it doesnt matter how much money we ask for, all they care about is the interest that we have to pay back? how can we pay off the debt? We, in time, would pay more interest than we borrowed if the interest rate is low, it will take a lot of time, but….we would be paying more than we asked for correct?

That is the point of lending money,to make money off the interest. That’s exactly what credit card companies do. They go to unexperienced people and give them all these offers. They hope the person will get themselves to the point where they are only able to pay off the interest. That is why there are alot of credit card companies that advertise at collges.

Even wasted money spent by the government is money spent by the government.

If we import less, then that may mean more domestic production, sure. But it also means far less potential purchasers of our national debt: that money spent on imports comes back to finance $400 billion of our debt each year.