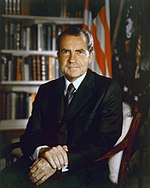

The Nixon Shock was a fascinating period in American economic history. Basically, the USG had way overspent on its budget and the rest of the world was suspicious about the value of the US dollar relative to its gold reserves. When France called us on it and demanded gold in payment for goods and services, Nixon decided – unilaterally – to take the US off the gold standard.

The Nixon Shock was a fascinating period in American economic history. Basically, the USG had way overspent on its budget and the rest of the world was suspicious about the value of the US dollar relative to its gold reserves. When France called us on it and demanded gold in payment for goods and services, Nixon decided – unilaterally – to take the US off the gold standard.

He didn’t do it in consultation with anyone else. He just did it. It caught the Congress, banking community, and the world by surprise. Since then, the dollar has gone through severe inflation and the price of gold has gone significantly upward from $35 per ounce.

There is some speculation about the US possibly returning to a gold or bimetallic standard. If it did, it could do so with a stroke of the president’s pen. However, given the massive deficits we have here, that would not be a good idea: lenders might demand payment in the form of precious metals, and we’d be right back where Nixon was in ’71…

The New York Times has a whole topic section for the Gold Standard.

http://topics.nytimes.com/topics/reference/timestopics/subjects/g/gold_standard/index.html

Not very recent though. =/

I was doing a little research on the gold standard and I found a site that explains it very well. It has the pros and cons and it also tells how the U.S. could go back.

http://useconomy.about.com/od/monetarypolicy/p/gold_standard.htm

THe gold standard does seem like a good way to keep the current value of the dollar up but the also severe repercussions if we have more paper money than gold. The “standard” is not good for the U.S. at all. So it seems futile for America to turn back.

Ok, this may be a stupid question, but how did the Gold standered get created in the first place? It just seems kind of random, “I will trade you this shiny rock for that cow”

Hey Emily this website will answer your question, I believe.

http://www.econlib.org/library/Enc/GoldStandard.html

Let me know if this answers your question?

While the gold standard can prevent a country from amassing huge sums of debt it can still cause a country’s economy to crash as the website Shaun posted said(the website uses the time period from 1890 to 1905 during which the US had five major recessions while on the gold standard as an example). If a country’s concern to keep it’s gold while on the gold standard can cause a recession and a country off the gold standard easily acquires debt to the point where it’s in a sticky situation, what should a country do? Where is the middle ground to this paradox?

Good questions Hugo! But before we can know where the middle ground is it we must find it and claim it as ours!

Whatever do you mean by that, Shaun?

But the reason gold standards allow severe recessions is that they hamper fiscal and monetary policies that can smooth out recessions. That’s coming up in the next few weeks of Econ.

I mean that there may not be a middle ground because the two policies are the exact oppsite of each other. And if there is such a middle ground we should find it and keep it to ourselves so that way the U.S. will be the dominate country in the economy. I know it sounds selfish but if we dont want to live in a world that all the countries have and equal advantage and the economy doesnt move at all. Next thing you know we will end up having a thing like the E.U. Does this sound correct at all?

How does gold effect the value of a dollar?

the gold effects the value of the dollar due to the fact that all of the U.S’s money has been backed up by the gold for a hell of a long time. If the cost for an ounce of gold goes up yet the dollar stays the same, then i believe that means inflation will happen because the dollar isn’t worth as much as it was when the ounce of gold was cheaper.

the gold effects everything that has to do with our currency and how everything has been set up over the years.

what is the price of an ounce of gold now? way up from 35 right, If dollar is inflated, then gold is lower?

Ok the price of gold at 6:35pm today was 997 dollars per ounce. This is way greater than the 35 dollars per ounce of Nixxion’s Day. And as i saw in the chart from the website http://www.goldprice.org/

The price of gold tends to max out at around 997 dollars and then dip down slightly and go back up in the course of a day. So if im getting the right. One who wanted to sell their gold should do it now, to make the most profit, wait for the price to dip, buy gold at its cheaper state, wait, then sell when it peaks back at 997 a few hours later.

Wouldn’t you hold on to the gold for longer than a few hours? I would watch the market trends over the last few months rather than the last few days.

@ Wilson: gold crossed the 1000 mark a while back. You’ll need to revise your spot trading algorithm.

@ Harrison: Why not hold it for only a few hours? With enough volume, one can beat the commission fee and realize profits. I know of several zillion traders that take up an overnight position on gold, essentially buying it at market close and selling it at market open. It’s a strategy intended to beat certain other types of traders in what can best be described as the ultimate online casino game: stock and commodity trading.

***

Gold does not now affect the price of the dollar. Rather, the fall in the value – or anticipated value – of the dollar drives up the price of gold in dollars. Other currencies are also falling against gold, so it looks like people in the market anticipate much more inflation around the world.

You would have to have a lot of money if you wanted to make money off day trading gold. Imagine how much you would need if just one ounce is over a thousand dollars. You need to be trading pounds of gold to make any worthwhile amount of money.

In response to Emily’s comment on 9/02/2009 17:35. The reason gold is valuable is the same reason why economics exists, the problem of scarcity. People like shiny stuff, there’s a limited amount of which many people want,which leads to its high price.

Wow, so our economic problems today are partly due to the fact that cavemen liked shiny stuff?

Not really, because as trade grew more complex so did economics. Shiny stuff was just something everyone wanted and believed had value as a luxury. So in a way our economic problems today have to do with the fact that cavemen wanted something they didn’t have.

This is just a question… I’ve heard that the penny is pointless and useless, so why doesn’t the government get rid of the penny, have a massive recall and melt all the pennies down and sell the metal for profit? I’ve heard the it costs more to make a penny than it’s worth…

And we have a lot of pennies, would that be, excuse the pun, a pretty penny. lol

Then the $X.99 sales tactic would be gone. And if the government wanted to get rid of coins they would have to get rid of all of them at the same time.