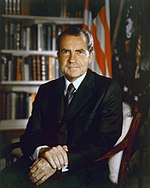

“The US national debt is now over $11 trillion dollars. The interest on our national debt is now $340 billion. This is about at 3.04% rate of interest. In ten years the Obama administration admits that they will add $9 trillion to the national debt. That would take it to $20 trillion. Let’s say that by some miracle the interest on the national debt in 10 years will still be 3.09%. That would mean that the interest on the national debt would be $618 billion a year or over one billion a day. No nation can hold up in the face of those kinds of expenses. Either the dollar would collapse or interest rates would go through the roof.” – Richard Russell

Ouch. That’s if the interest rates stay low. If the interest rates went up by 1%, that would increase the interest payments by $113 billion today and $206 billion in the future. That $618 billion, by the way, would be a third of all tax receipts, so that increase of 1% would mean almost half our taxes would go toward just paying the interest on the debt.

But if we do not run up the debts, we risk an even worse nightmare scenario with crushing deflation – as prices collapse, so does consumer demand and with it, the engine that drives our economy.

But that engine is getting an awful lot of gas… in order to avoid a standstill, we may be driving the economy into a brick wall.